Industry Report

Trends Shaping Commercial Data & Analytics in 2025: Bay Area Forum Highlights

Learn more about key insights and best practices from industry leaders who attended Veeva’s Commercial Data & Analytics Forum in the Bay Area.

Veeva’s Commercial Data & Analytics Forum brought together industry leaders from early-stage biotechs to the top 20 biopharmas to discuss topics including:

- Trends in the current commercial data landscape

- How modern projected data better supports an ever-changing healthcare environment

- Best practices for discovering treatment usage in the patient lifecycle and how to identify net-new targets

The group also participated in roundtable discussions, diving deep into ROI frameworks, data management and governance, and AI’s impact on commercial data and analytics.

Here are some of the key insights and takeaways.

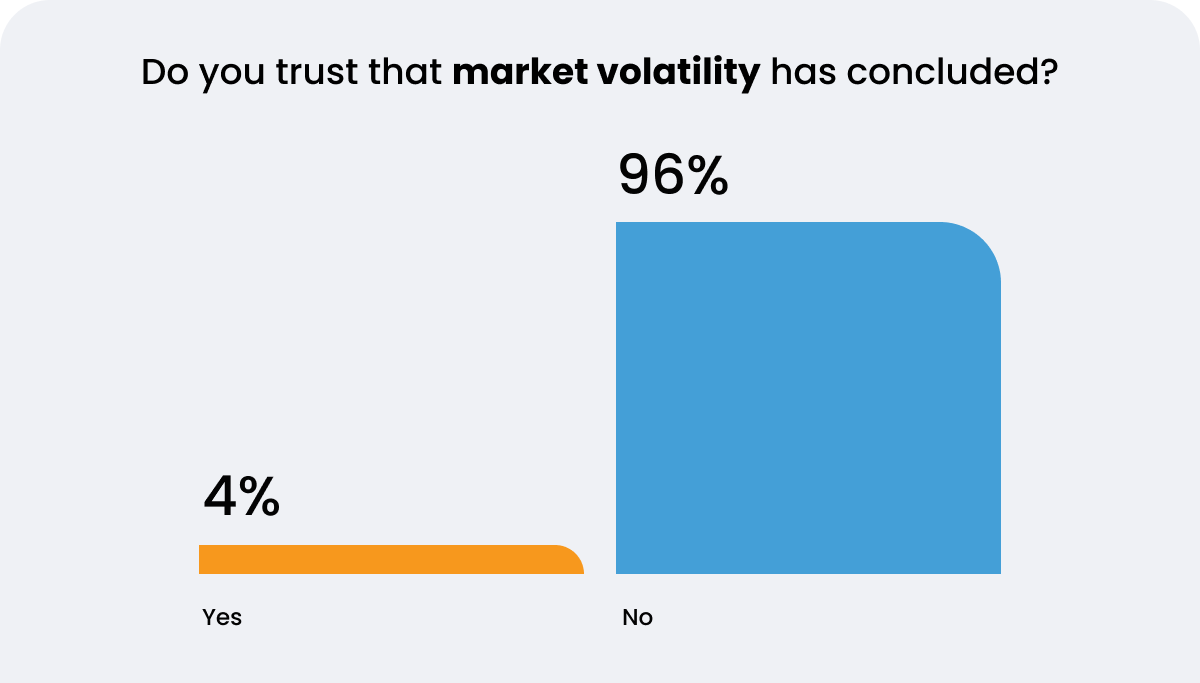

Market volatility will continue

2024 saw significant changes in the commercial data landscape. Unexpected market events limited or severely diminished foundational data sets. These events also impacted legacy data models, which were slow and inflexible to the disruption and changing landscape. Most participants (96%) agreed that this market volatility will continue for the foreseeable future.

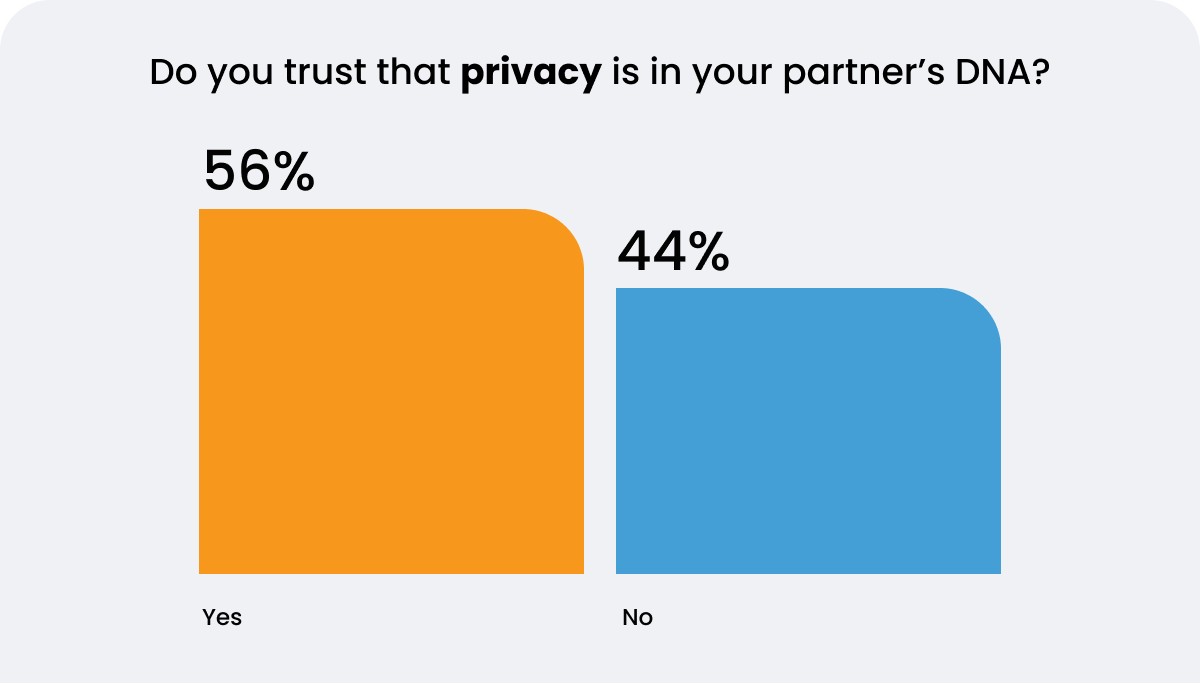

In this volatile market, over half the attendees (56%) trust that privacy is in their data partners' DNA. Both results highlight trust as a critical need for 2025 when identifying data partners, especially given the high cost and challenges of data access.

Innovative use of data in specialty medicine

During the panel discussion, a health data partnership expert, a VP of analytics at a top 20 biopharma, and an analytics leader from a biopharma tech platform addressed topics including the continued targeting of brands at growing rates and the focus on smaller patient populations with an emphasis on patient experience. The clear takeaway from this discussion was that stakeholders need to think not only about caregivers but also about patients and how to integrate the relevant data compliantly.

In addition, historically, from a biopharma management perspective, the thinking has been more rigidly oriented towards the HCP. However, as the power of the prescription decision becomes more diffuse, teams have to adapt. In turn, data collection must also adapt to make an HCP prime approach more sophisticated and account for payers, pharmacy benefit managers (PBMs), and other customers.

On the innovation front, teams are trying to do more with data. They are leveraging connectivity and synergy across all the available data to empower the whole continuum of care. There are also many opportunities to take information that’s previously been in silos and make it accessible across the organization. The question then becomes, who owns the responsibility for innovation? Is it the people closest to the data or to the business? Both stakeholders are necessary since tech-driven innovation and business strategy inform technical strategy. It’s essential this planning is done in a compliant way and with the right guardrails.

AI must be focused and strategic

Attendees expressed that there is considerable corporate pressure to figure out how to leverage AI, and some organizations shared that AI fatigue is setting in. Leaders shared best practices and learnings from their organizations, including:

- Be strategic about what use cases your organization wants AI to help solve vs. trying it everywhere.

- Integrate AI into the existing workflow process, or it can become another area where work needs to take place, creating additional overhead and potentially slowing things down.

- Some initial pilots have shown promising returns, specifically around sales force effectiveness and dynamic targeting and segmentation. However, significant business outcomes have been elusive and hard to demonstrate to senior management.

ROI frameworks should be scalable and aligned across the business

Biopharma leaders agreed that creating a standard ROI framework can be challenging, especially across organizations operating in multiple therapeutic areas or commercializing for the first time. Attendees shared how:

- Defining and measuring ROI involves basic metrics but becomes complicated as you scale.

- ROI needs to be part of the purchase decision, not an afterthought. This ensures complete alignment across the organization for appropriate pull-through.

- Failing fast is ok. Don’t hold on to data for too long trying to achieve an ROI when it is clear it’s not working.

Successful data management and governance require a holistic approach

Attendees shared best practices for designing, planning, and maintaining data assets. They emphasized the importance of making data investments based on both current state and future needs to scale. Takeaways included:

- Keep the business top of mind when designing data network architectures. Start with the goals and work back. Involve stakeholders in the process to build trust in the data.

- Data products require user training on tools and data to accelerate use. There is a real need for "how-to" education, e.g., how to create key metrics and segments when reporting.

- Demonstrating ROI is key to data acquisition justifications and planning.

- To reduce the workload for data to be “analytics-ready,” look at emerging themes instead of taking on initiatives for very bespoke use cases.

Modern projected data is necessary in dynamic healthcare

With specialty drugs now representing around 75% of the approximate 7,000 new drugs under development, the focus on novel therapies cannot be overstated. In addition, the growth of orally administered products in complex and chronic disease areas — FDA approvals for 2024 showed that roughly 50% of novel therapies were oral formulations — means the distribution model shifts from legacy retail channels to heavy non-retail, such as specialty pharmacy. Finally, there is the continued evolution of mixed routes of medicine administration, most commonly in the form of IV infusion and subcutaneous administration.

Given these trends, the traditional data model that biopharma organizations have been leveraging has struggled to keep up with today's increasing complexity. Legacy data models have issues with:

- Distributor data with wide variability

- Blocked specialty pharmacy data

- Projected retail data that doesn’t take into account the growth of in-office or non-retail

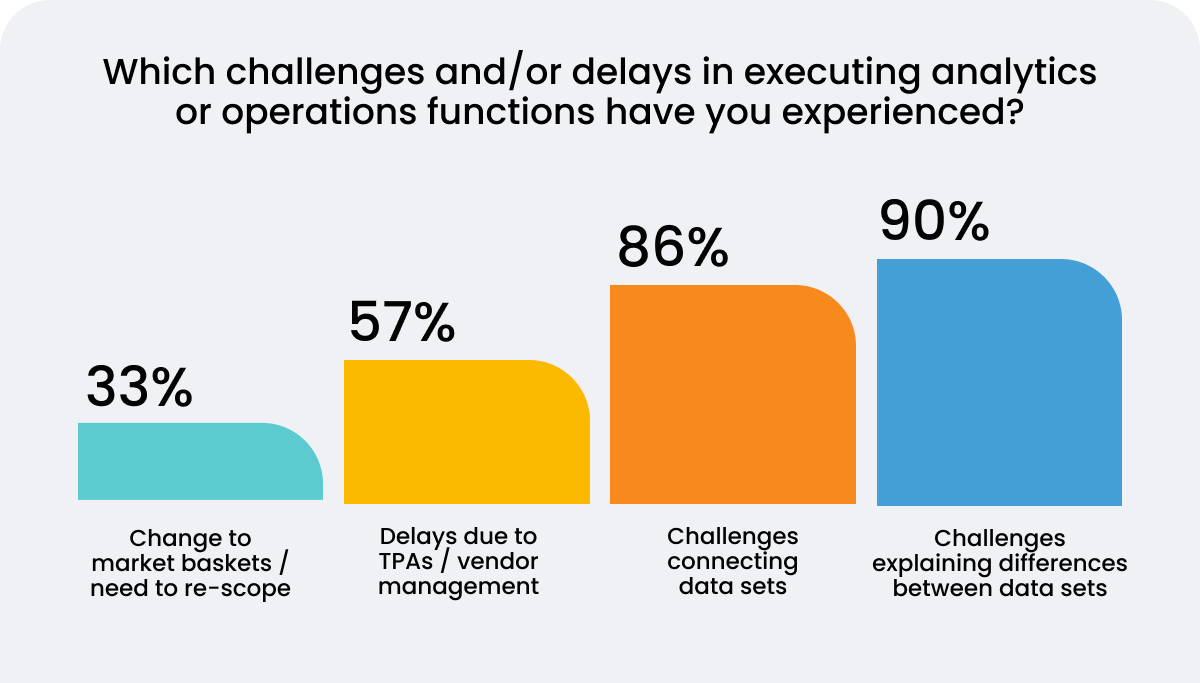

The attendees shared their challenges with the current data environment and cited issues around explaining the differences between data sets as the top challenge.

However, all challenges point to one factor — legacy data products are missing substantial volume, and organizations need a more modern data model. Projected data removes the bias in patient claims and distributor/sell-in data. Veeva delivers this data with a complete view of prescriptions and procedures, including retail and non-retail, with unlimited access.

Demonstrating the benefits of modern projected data

To understand how a more complete picture of HCP activity improves a brand’s ability to find relevant HCPs and optimize territory alignments and field team sizing, attendees reviewed an analysis of a launch scenario in the schizophrenia market. The analysis showed that by using projected data, which included total administrations, the brand was able to:

- Find 8,830 more prescribers

- Uncover 24K more patients via HCPs represented in TMx only (a metric that legacy data didn’t provide)

- Design 40 additional territories

- Identify $150 million in incremental revenue

Targeting and segmentation is a constant in complex patient pathways

With complex patient pathways, segmentation and targeting is a constant in prioritizing who, when, and how teams engage with customers.

However, there have been changes in the market, including:

- Smaller patient populations with rare and more complex diseases

- More drug platforms and launches

- More decision-makers and influencers

- More stratification of go-to-market models

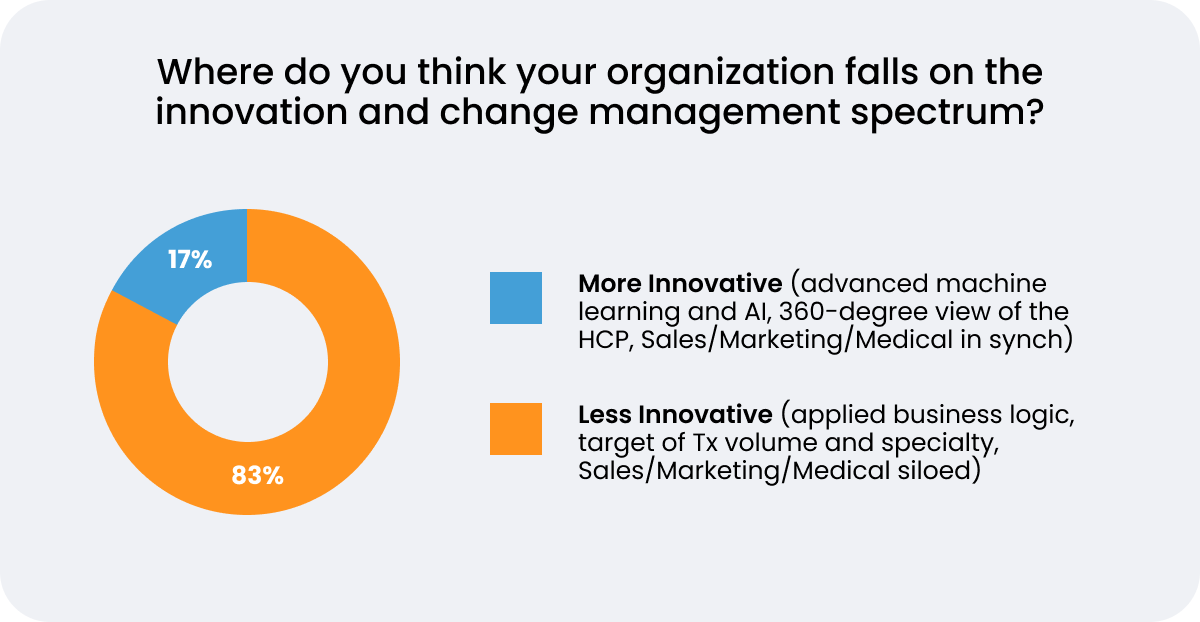

Despite these changes, biopharma has not modified its approach. How people present their strategies and what they actually do are very different when moving beyond the pilot phase (e.g., stakeholders proclaiming their strategy is focused on advanced AI, a 360-degree view of the patient, and having key functions in synch, vs. applied legacy business logic, targeting on Tx volume and specialty, and keeping those key functions siloed).

In polling questions about innovation and change management, attendees agreed that when acquiring new data capabilities, change management is lagging. There needs to be assurance that the field team understands how targets are prioritized, the behavior that needs to change, and the messages that resonate with customers. Robust data and innovative approaches are required to quantify complex patient care pathways, given the inability to identify key patient populations, difficulty getting to key HCPs quickly, and the existing challenges of accessing and integrating data.

Open and connected data ecosystems allow users to design complex customer journeys. Analytics need to be integrated and can be operationalized for the field with the correct tooling. Finally, and most importantly, the pull-through and activation of a data strategy requires long-term organizational change to realize the benefits.

About Veeva Compass Suite

Veeva Compass is patient and prescriber data for segmentation and targeting. It supports biopharma commercialization by providing visibility into patient and provider activity within the U.S. healthcare ecosystem.

Explore the full breadth of Veeva’s commercial data offerings here.