Blog

Europe’s HCP Access Is Back but Not as We Knew It. Will Your Field Team Benefit?

Dec 08, 2022 | Aaron Bean

Dec 08, 2022 | Aaron Bean

It is a widespread industry assumption that rep access to healthcare professionals (HCPs) is still muted compared to the pre-pandemic era. Analysis of 600 million annual HCP-rep interactions globally proves this is not the case. HCP access is back, but interactions are becoming more selective and increasingly virtual.

Field access to HCPs has also returned at a high rate in Europe, but not all companies benefit equally. HCPs across the region are meeting fewer biopharma companies, dialing up the expectation that their interactions are as productive as possible. With significant variation in field effectiveness among companies, teams must evaluate whether their targeting strategy and channel mix are achieving the right reach.

The latest Veeva Pulse Field Trends Report provides granular detail on European field engagement activity. For the first time, we’re able to measure the level of access attained by companies with different field force sizes by specialty, channel, and country.

1. European field access returns at a higher rate than expected

Globally, HCP access has climbed from the pandemic-era low of 20% to 60% this quarter. The data shows that more than half of accessible HCPs now prefer to meet through a mix of video and in-person channels.

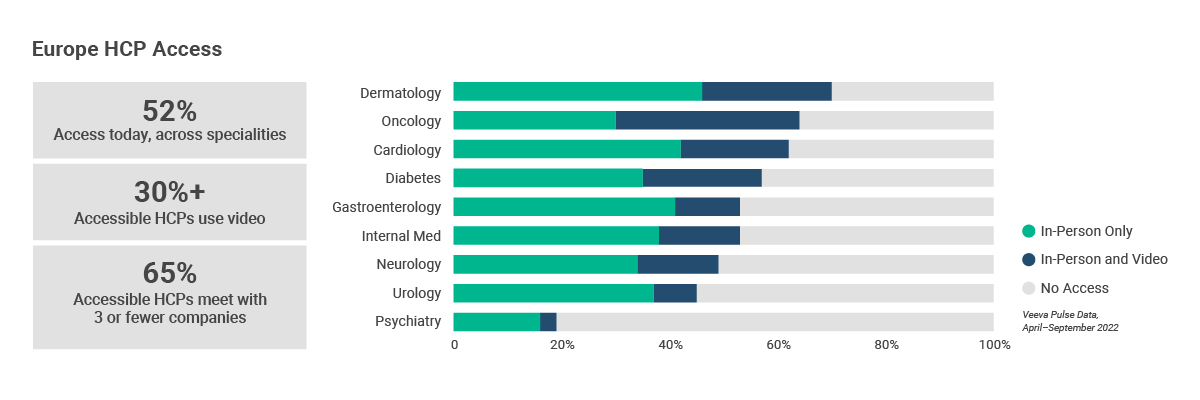

A similar trend is discernible in Europe, where HCP accessibility across specialties averages 52%. Once you consider that not all HCPs are being targeted, this figure implies high coverage of priority HCPs. In fact, Dermatology, Oncology, and Cardiovascular have more than 60% access.

Video is proving to be an important tool to extend reach and virtual engagements are now mainstream across the region. Almost one-third of accessible HCPs choose to connect with reps using video [Figure 1].

However, access is not the same for everyone, as HCPs have become more selective about which biopharma companies they meet. On average, 65% of accessible HCPs in Europe limit meetings to three or fewer organizations. Access is most restricted in the U.K. where 94% of accessible HCPs meet only one or two companies.

Figure 1: HCP Access by Specialty and Channel (EU-5)

Source: 3Q22 Veeva Pulse Field Trends Report

Source: 3Q22 Veeva Pulse Field Trends Report

Companies that are struggling to engage key customers should assess their targeting strategy, as their peers may be enjoying more success. Veeva analysis shows that as a result of digital engagement, some companies with small field forces have achieved the same level of access as competitors with much larger field teams.

2. Content use during video meetings accelerates in Europe

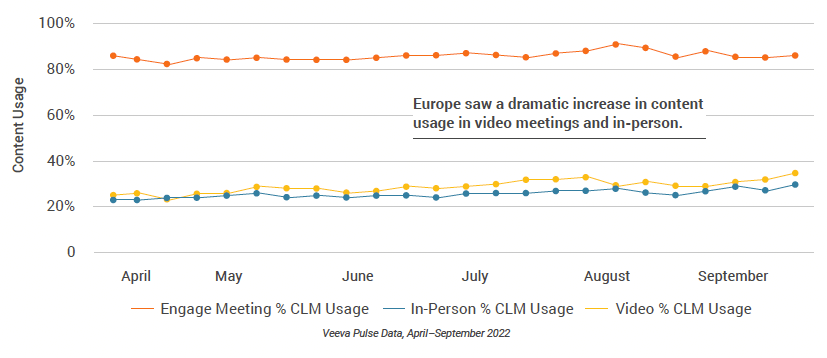

Over the last quarter, there has been a dramatic uptick (10% growth) in the use of content in video calls in Europe, which has outpaced its use during in-person meetings (7% growth). Content use has accelerated faster in Europe than elsewhere worldwide, despite covering the summer period when field activity drops sharply across the region [Figure 2].

Content has an impact on the quality and duration of video calls. Reps that use CLM are best placed to tailor their field calls by presenting the latest content and documenting customer feedback to messaging. Companies know this and are investing in their content capabilities to improve the overall HCP experience.

The industry is making strides to embrace content-rich video calls as a way to engage customers efficiently. However, behavioral change takes time, which is why there is still plenty of room to grow video in the overall channel mix. Companies that do not plan to adapt their processes and rep training strategies risk being left behind.

Figure 2: Content Usage by Channel, Europe

Source: 3Q22 Veeva Pulse Field Trends Report

Source: 3Q22 Veeva Pulse Field Trends Report

3. An effective European field strategy requires granular country data

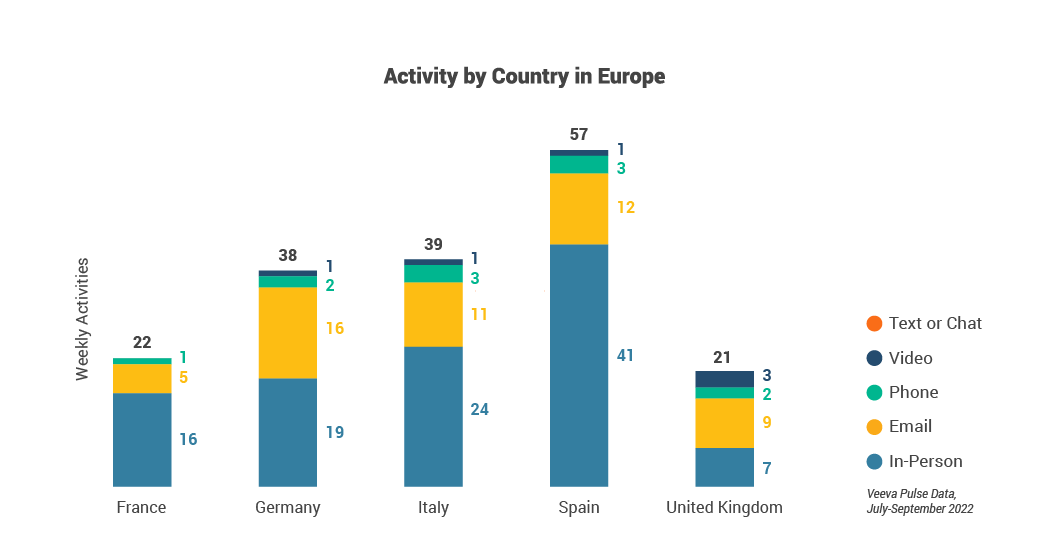

Pharma companies planning their Europe-wide strategy face the challenge of accommodating vastly different engagement models in each country.

For instance, reps in France and the U.K. record near-identical weekly channel activity of 22 and 21 engagements respectively [Figure 3]. Yet, reps in France are more than twice as likely to rely on in-person meetings than their counterparts in the U.K. Regulatory differences and cultural factors have resulted in diverse channel mixes.

In the U.K., pharma company reps are restricted to a maximum of three solicited meetings with the same rep each year (although there are no limits on meetings if an HCP reaches out to a rep). In France, regulation of in-person access is happening at a slower pace. Field teams in the U.K. have plugged this gap with a heavier reliance on email and video. In fact, U.K. video usage is higher than elsewhere in Europe, averaging three weekly meetings per user.

Figure 3: Field Activity by Channel, Europe

Source: 3Q22 Veeva Pulse Field Trends Report

Source: 3Q22 Veeva Pulse Field Trends Report

Spain’s model looks different again, with a heavy emphasis on volume of activity. At a recent Veeva roundtable for pharma companies, attendees noted that although omnichannel is perceived to be low in Spain, reps in this country take a high-volume approach to multiple channels. Spain ranks second for email activity in Europe, and joint first for phone calls, in addition to in-person meetings.

Discover how your field team could become more effective

The European findings show that the winners securing time in HCPs’ diaries use digital more effectively to broaden their reach. They attain an optimal channel mix between video and in-person activity and ensure meetings are content-rich so key messages land effectively. The powerful combination of digital and content has helped some overcome the hurdle of a smaller field force size to attain similar reach to competitors equipped with many more reps on the ground.

The full report explores different ways to improve field force effectiveness. For instance, by comparing HCP access to field force reach, you can determine whether HCPs are really inaccessible or simply limiting their access. These insights help highlight efficiency gaps and could change the direction of your channel strategy.

There is no one-size-fits-all model for Europe. Engagement and access vary by country and specialty, company, and channel. Benchmarking your company’s performance to peers in each country is important. Only then will you be able to define, at a granular level, the capabilities and KPIs needed for each market.

Read the Veeva Pulse Field Trends Report to learn all the latest global field trends and find out what’s happening in your market.