eBook

Agile Field Force Planning:

Three Steps to Create Better HCP Engagement

Field force in-person activity is up 2% since 2023, representing more than 70% of the total European biopharma channel mix. At the same time, 84% of healthcare professionals (HCPs) prefer to maintain or increase their share of virtual interactions with biopharma companies. For field teams, understanding HCPs’ preferences can mean the difference between effective engagement and missed opportunities.

Your field team’s success, however, is often determined long before reps initiate their outreach. Incorporating field force activity data into field force planning is essential to optimize HCP targeting, build channel strategies, and personalize interactions with each and every customer. But rigid planning cycles, lagging and siloed data sets, and limited access to vendor data can make it difficult to see these trends – never mind react to them.

In this ebook, we’ll cover how commercial operations teams can optimize field force planning by:

- Building plans based on real-world trends, not assumptions

- Designing and deploying plans with speed and precision

- Executing your plans and adapting with feedback

Why traditional field force planning falls short

Traditional field force alignments are a complex, highly manual, and inflexible process. For a truly customer-centric approach, your field force planning can’t rely on lagging industry data or one-size-fits-all strategies. Here are three reasons the traditional approach to field force planning isn’t effective:

- Outsourcing costs: Constant budget scrutiny and the pursuit of streamlined operating models have caused some biopharma companies to consider outsourcing their field force planning process. But, outsourcing has its own risks – it can have hidden costs for customization, there is less control over your data and strategy, and cookie-cutter solutions are often unable to meet your company’s specific needs.

- Manual approaches: Homegrown alignment solutions give companies more control over the process, but teams often need to work across multiple teams and spreadsheets. This approach is resource-intensive, inefficient, and error-prone. It also limits insights, because it’s much more difficult to spot strengths and weaknesses in your strategy with fragmented data.

- Inflexible strategies: Traditional alignments might happen at scheduled times quarterly or every six weeks. This slow-moving approach can’t effectively account for shifts in the market, new product launches, or evolving field force engagement trends. It also makes it more difficult to capture and act on feedback from reps when alignments are wrong.

Creating an agile approach to field planning

The growth of data and digital channels, frequent market disruptions, and increased competition have made field force planning more challenging in recent years.

For commercial teams to be successful, territory alignments must evolve far beyond inflexible and highly manual “plan-execute-measure” constructs. Field force engagement data can help you understand what’s working – and what’s not – when engaging target HCPs.

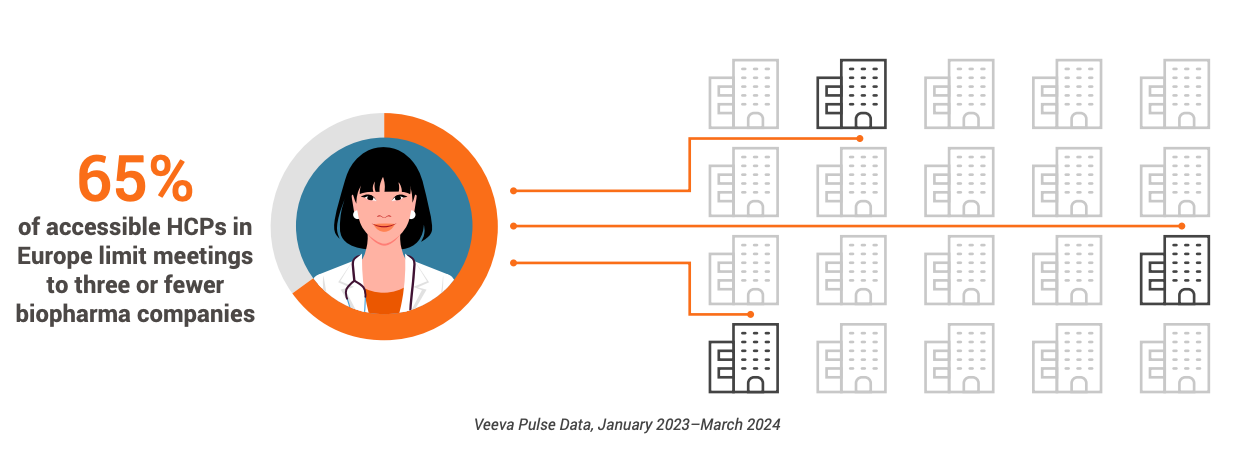

That competitive edge is increasingly important: on average, 65% of accessible HCPs in Europe limit meetings to three or fewer life science organizations. In the U.K., HCP access is most restricted, with 94% of accessible HCPs meeting only one or two companies.

Combining your field team’s activity data and customer data into a precise, dynamic, and omnichannel-enabled plan creates an agile approach to market. Historical interactions, channel preferences, and feedback from your field teams are key to building better relationships with HCPs, targeting more effectively, and optimizing engagement.

This agile approach to territory alignments also allows you to balance the needs of the business, HCP preferences, and field force feedback. Field teams will engage more effectively on the channels your customers prefer by:

- Using channel data and insights to inform channel strategy

- Accounting for HCP’s preferences to improve the customer experience

- Enhancing field team execution by incorporating field feedback

STEP 1 Build your plan on benchmarking and channel insights

Field force activity data can help you understand what channels are the most effective. This data sets the baseline, and from there you can benchmark your company-specific data against the rest of the industry.

This data will help you answer key questions like:

- What differences are there between regions?

- What channels deliver the most value?

- Where are the gaps in channel strategy?

Three trends impacting field force planning

Veeva Pulse data is the industry’s benchmark for field activity. Here are three trends impacting the industry this year:

- HCP access declined from 60% in 2022 to 45% in 2024. While some HCPs only engage in person, that data also showed the importance of a hybrid approach, as 50% of accessible HCPs engage via a mix of in-person and video.

- Although many field teams are likely celebrating the return of in-person meetings, commercial teams shouldn’t abandon their hard-won digital access with HCPs. Video meetings combined with in-person resulted in three times greater promotional response over in-person alone.

- Content sharing frequency in Engage, a digital engagement platform, is twice that of in-person and other video meeting channels. Digital content sharing can increase promotional impact by 2.5 times vs. meetings where content isn’t shared. In an analysis of Veeva Pulse data, the top three biopharmas used content in 70% of meetings vs. 18% for the bottom three, creating a wide competitive advantage.

Combining this activity data with existing customer data can lead to more sophisticated insights and improve your segmentation, targeting, and multi-channel planning. Given only 27% of HCPs say that biopharma companies communicate with them in a relevant and personalized way, teams that can personalize the engagement approach will be at an advantage. Relevant questions include:

- How digitally engaged is this customer?

- How successful have remote meetings been?

- How well does this customer engage with content?

Through this assessment, you’ll learn how your customers prefer to interact with your field teams, depending on where they are in the customer journey and geographic location (for instance, although Europe tops email use globally, Veeva Pulse data shows that Spain leads in-person interactions). This allows you to set the foundation for agile field force planning by consistently updating your strategy based on timely, relevant data that will raise your reps above the competition.

STEP 2 Design and deploy your field force plans

Aligning field activity trends with customer preferences allows you to optimize the overall channel mix for the best commercial impact and customer experience. However, traditional field planning using spreadsheets, disparate data sources, and siloed technology is inefficient, cumbersome, and slow. Territory alignment software that is integrated with your CRM platform offers a best-in-class approach to field planning.

Field interactions recorded in your CRM platform – including the type of interaction, how the engagement went, channel type, and content usage – allow you to monitor interactions with HCPs over time. Using this data, you can assign priority level and weight to each channel in your territory alignment solution to ensure that reps are using optimized multichannel plans and not reverting to channels they are more comfortable with.

This approach empowers field teams to execute their engagement strategy in a sophisticated way, at scale, as even field reps with small territories will often have too many HCPs to determine the most effective approach for each customer.

"Align is the only solution that is fully integrated with CRM. We can select our target group, build our multichannel cycle plans directly in Align, and then we can push through to the end user, supporting their goals and approval process." Global Head of Commercial Operations - A leading global biopharma

STEP 3 Use field feedback to improve your approach?

No matter how precise your data and strategy are, there is no substitute for real-world feedback, as sometimes data may not capture the realities on the ground. For example, a target physician may not be accessible or could prefer virtual meetings over in-person interactions. When this happens, you need to be able to easily capture feedback from your field team and act on it.

Field feedback can also help quickly reconcile broader discrepancies in the planning process. For example, when GSK’s commercial operations team switched to an outside data solution, the new dataset created a skewed alignment based on mailing addresses, rather than the practice addresses that the field team uses for calling on HCPs. By enabling Veeva Align’s Integrated Territory Feedback, the reps identified nearly 70,000 records in the customer reference data that needed to be removed.

Giving home office/remote teams the ability to provide early, integrated feedback, in a single-app experience with Veeva Vault CRM ensures that plans are kept current without waiting for a fixed date in the planning cycle. When feedback is captured in a smooth, convenient, and consistent process, it:

- Speeds up alignment adjustments

- Reduces errors from manual data capture

- Prioritizes the field team’s time with the right targets

Most importantly, it gives your field team agency in the process and confidence that the data will support their customer engagement goals.

Conclusion

Biopharma companies that take an agile approach to territory alignments can use field force activity data as the foundation for dynamic and precise omnichannel plans, creating a competitive advantage. As field teams supplement quantitative measures of success with more qualitative measures, the ability to adjust plans quickly with their feedback is a key differentiator.

Learn how agile, data-driven field force planning can move your team beyond measuring reach and frequency to deliver a better customer experience.