How The IVDR Transition Impacts You

The in vitro diagnostics (IVD) industry has been caught between a rock and a hard place. The global pandemic has required full attention. In parallel, Europe is pushing forward its modernization of the diagnostic regulations, away from the list-based to the rule-based approach that has governed medical devices for decades.

This regulatory change leads to a ten-fold increase of IVDs requiring notified body certificates to enter the European market (MedTech Europe survey).

A great many motivational quotes keep telling you everything must get worse before it gets better. Should these elements not be enough, there also is a shortage of notified bodies (NBs) and capacity for the IVDR. As of January 2022, six notified bodies have been designated for the conformity assessment according to Annex IX of the IVDR (NANDO database).

With only 47% of manufacturers having a contractual agreement with a notified body to certify their quality management system (QMS) and IVDs under the new regulation, a certain amount of loss of IVDs was to be expected in spring of 2022 (MedTech Europe survey).

This is alarming, as diagnosis is the basis for an estimated 70% of clinical decisions (BIVDA Value of IVDs). IVDs are in the unique position to enable personalised treatment, improve patient outcomes and save resources at the same time. Thus, losing or slowing progress on IVDs indirectly impacts treatment overall, but especially impacts niche and rare diseases that could lack proper diagnosis.

Like the heroic neighbour sharing the one egg that you forgot to purchase but so desperately need to finish the birthday cake, in December 2021, the European Commission adopted a proposal to enable a smoother transition for the IVD industry.

This amendment primarily modifies Article 110 of the IVDR with two major changes:

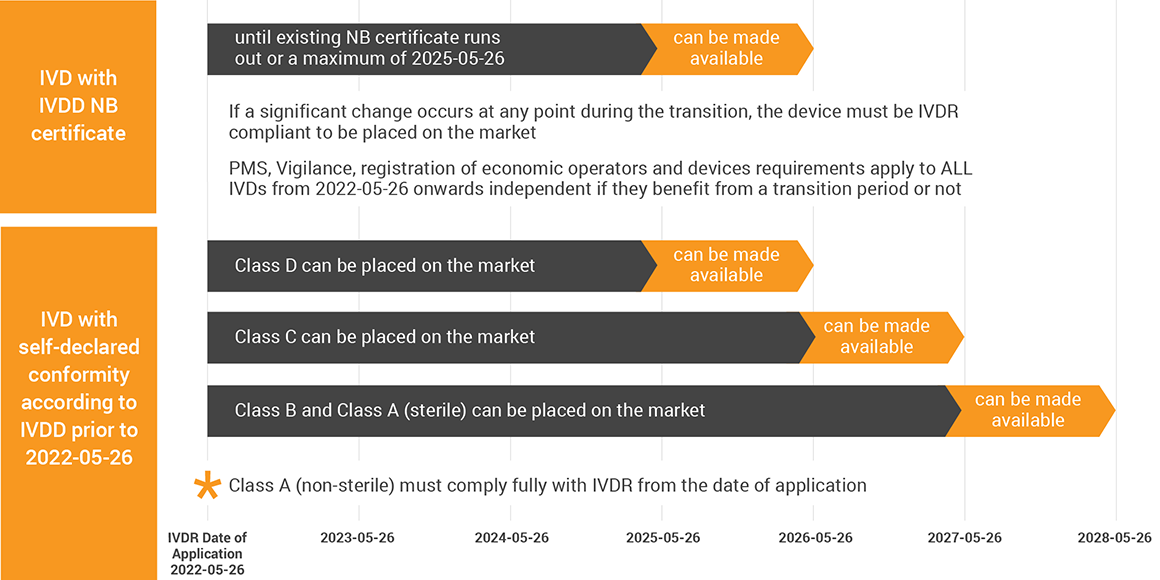

- a) moving the backstop date for existing IVDD NB certificates; and

- b) covering up-classified IVDs with transitional provisions depending on their IVDR risk class.

Unlike MDR, the adopted text does not touch the IVDR’s date of application of 2022-05-26, rather it widens the time for you to go through the existing bottleneck of NB capacity. As you know from Team-NB’s position paper on the expiring MDR certificates in 2024, NBs will already face a difficult workload during 2024 without IVD certificates added to the mix.

Moving the IVDR backstop date of existing IVD NB certificates to 2025-05-26 would avoid a collision between MDR and IVDR transitions ending at the same time. With only 8% of the IVDs (MedTech Europe survey) benefiting from the prolonged time, the more impactful change of the proposal are the transitional provisions for up-classified IVDs.

Without significant changes, class D IVDs can be placed on the market until 2025-05-26 and made available for one year. Class C gets an additional year, and Class B and A (sterile) IVDs can be placed on the market until 2027-05-26. There is a familiar caveat thrown into the mix stating that legacy devices will have to adhere to parts of the IVDR, as the changed text states: “[…] the requirements of [IVDR] relating to post-market surveillance, market surveillance, vigilance, registration of economic operators and of devices shall apply […]”. If not done so, review the MDCG guidance 2021-27 on questions and answers concerning economic operators, specifically Articles 13 & 14 of MDR/IVDR.

Should you be involved with IVDs that remain self-declared under IVDR, you cannot benefit from the transition periods and will have to comply fully with IVDR on the unchanged date of application. Therefore, if you have not done so already, now is the time to go into the MDCG 2020-16 IVDR classification guidance and get clarity on the transition times for your products.

Keep in mind, that during this transition any significant change is not possible until your IVDs are IVDR CE marked (refer to the MDCG 2020-3 for significant changes under MDR for now, until MDCG will publish one for IVDR).

Will this amendment solve all your worries like the smell of freshly baked cake? No, however, the change does ease the transition for existing IVDs. Though from the perspective of new IVDs, or significant changes during the phase of transition, the core challenge of increasing overall NB capacity is not addressed. The Member States’ authorities and all involved stakeholders will need to put in extra efforts and make resources available to make this transition a success.

Get clarity surrounding your IVD risk classes under IVDR. Take the time to investigate optimisation of your submission and registration procedures and systems. You would be surprised how much efficiency can be gained and resources freed when leveraging state-of-the-art purpose-built technology. Start educating your partners on their role as economic operators under IVDR.

Last, but surely not least, ensure that you start collecting the required clinical and performance evaluation data by learning from MDCG MDR guidance (e.g., 2020-6) to support your transition to IVDR. Especially post-market surveillance and performance studies highlight how digitisation on one common platform can help to increase cross-functional collaboration for Diagnostics organisations.

To learn more about how medtech leaders are tackling increasingly complex regulations with existing resources, read this white paper.