Pre-launch field planning requires a significant upfront investment in resources, analytics, and data. Discover how modern projected data delivers accurate and comprehensive visibility to better investigate markets, evaluate competition, and generate accurate insights.

Preview some of the key takeaways from the How-to Guide below.

Uncover your data blind spots

Traditional data sources for market and competitive intelligence for pre-launch activities are often too limited and rigid to support the complex, dynamic launch environment.

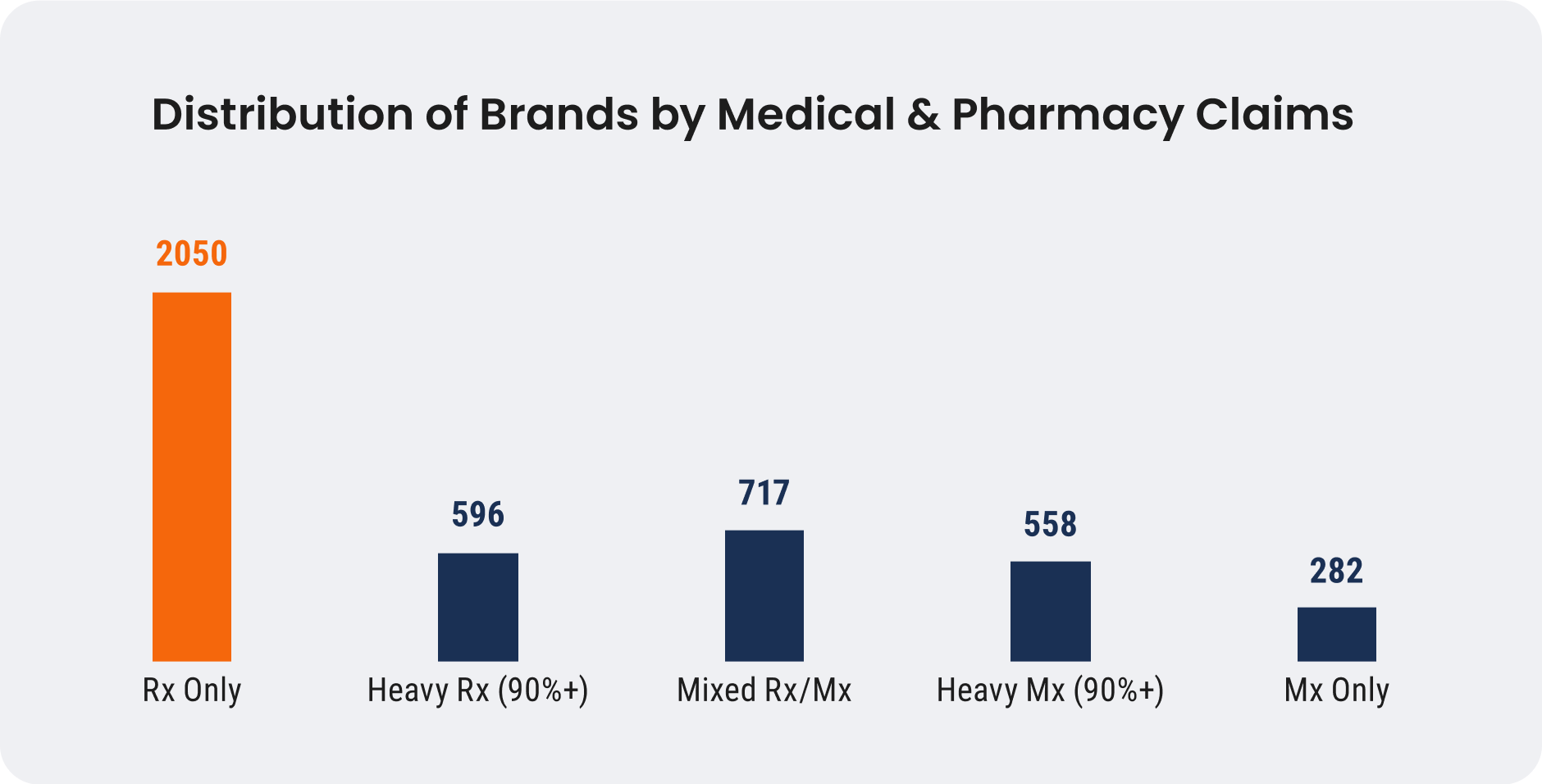

Many brands have some form of meaningful medical claims volume, which is where traditional projected data sources create a blind spot.

Brands in the middle have a hybrid of medical and Rx claims, which may represent hard-to-find prescribers who treat in a medical setting, and brands in the “Mx-only” category wouldn’t be visible with legacy projected data products.

Get all insights on how to uncover your data blind spots

Build a more accurate forecast

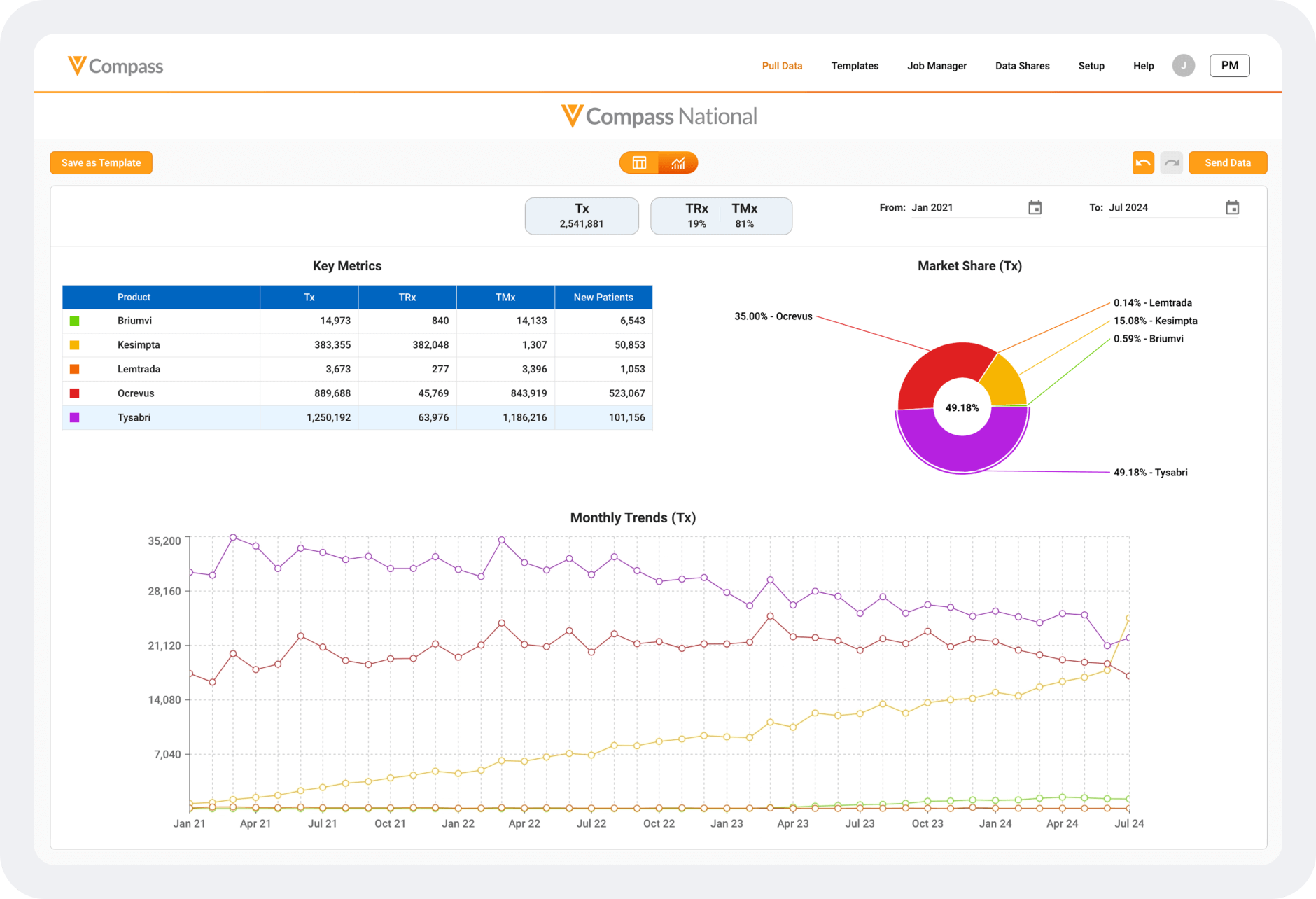

Modern projected data is more complete and provides financial inputs into the resourcing and strategy of your brand. These include market share, launch and growth trends, key market events, and patient-to-prescription ratios.

With all brand projections equivalent from an HCP level up to the national level, the forecast will easily translate to customer-level analytics and tactics.

Compass National provides state-level projections that make regional differences easier to understand.

Get all insights on how to build a more accurate forecast

Segment customers using a complete view of the market

While longitudinal claims provide detailed insights at an HCP and patient level, the data only shows a subset of the market and can be biased toward where there is coverage.

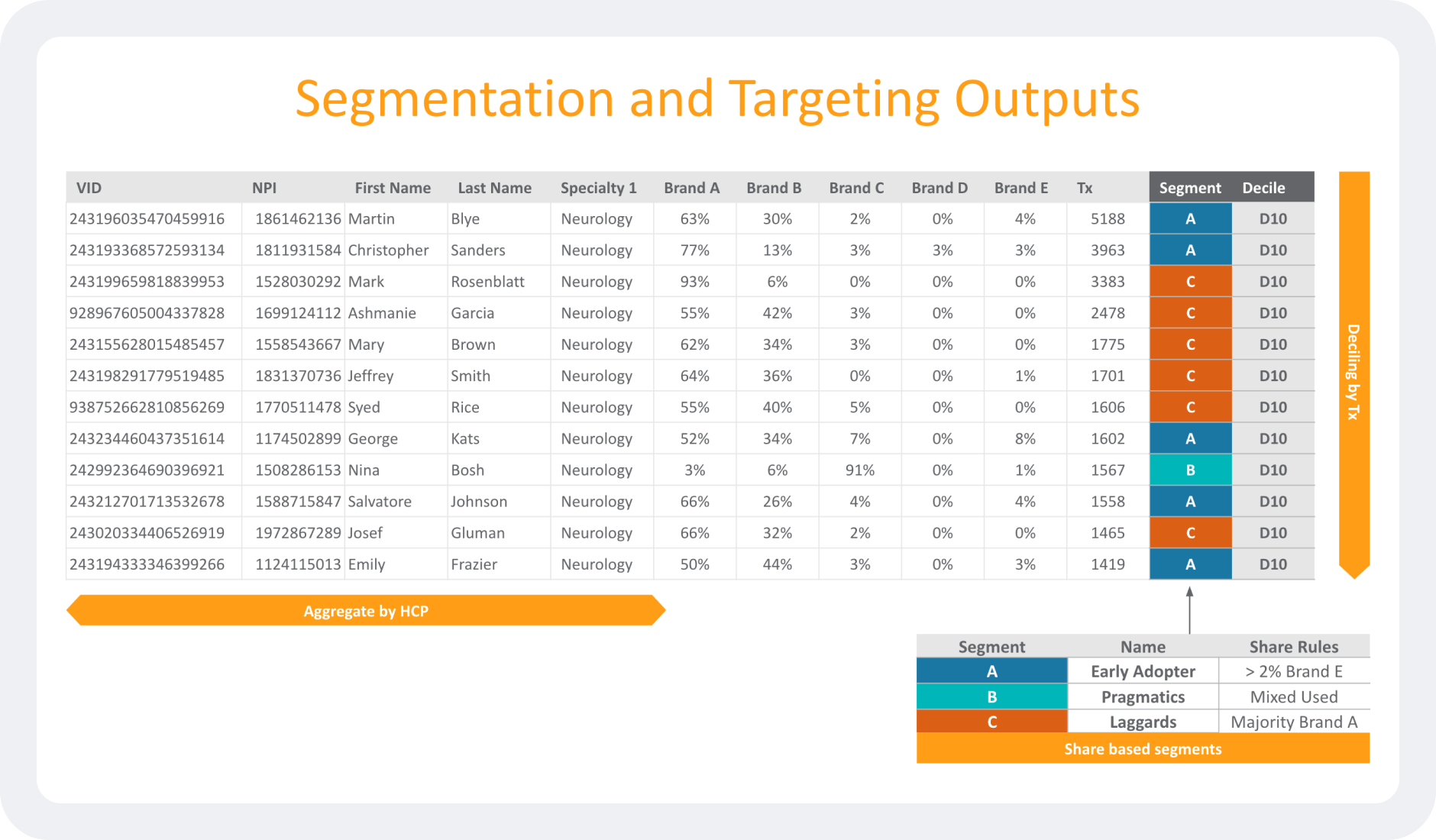

Segmentation hinges on complete views of transaction volume at an HCP level. Projections help avoid bias by filling in the voids from anonymized patient-level data and longitudinal data to create a fully representative view of the market.

Compass Prescriber groups customers based on how they might use a particular product. This enables segmentation by prescriber preference based on share of brands, types or classes of products, or even the care setting.

Get all insights on how to segment customers using a complete view of the market

Prioritize prescribers based on volume and opportunity

Effective targeting relies on prioritization and maximizing your limited resources. Emphasis should be placed on volume and opportunity to ultimately find highest potential and relevant customers.

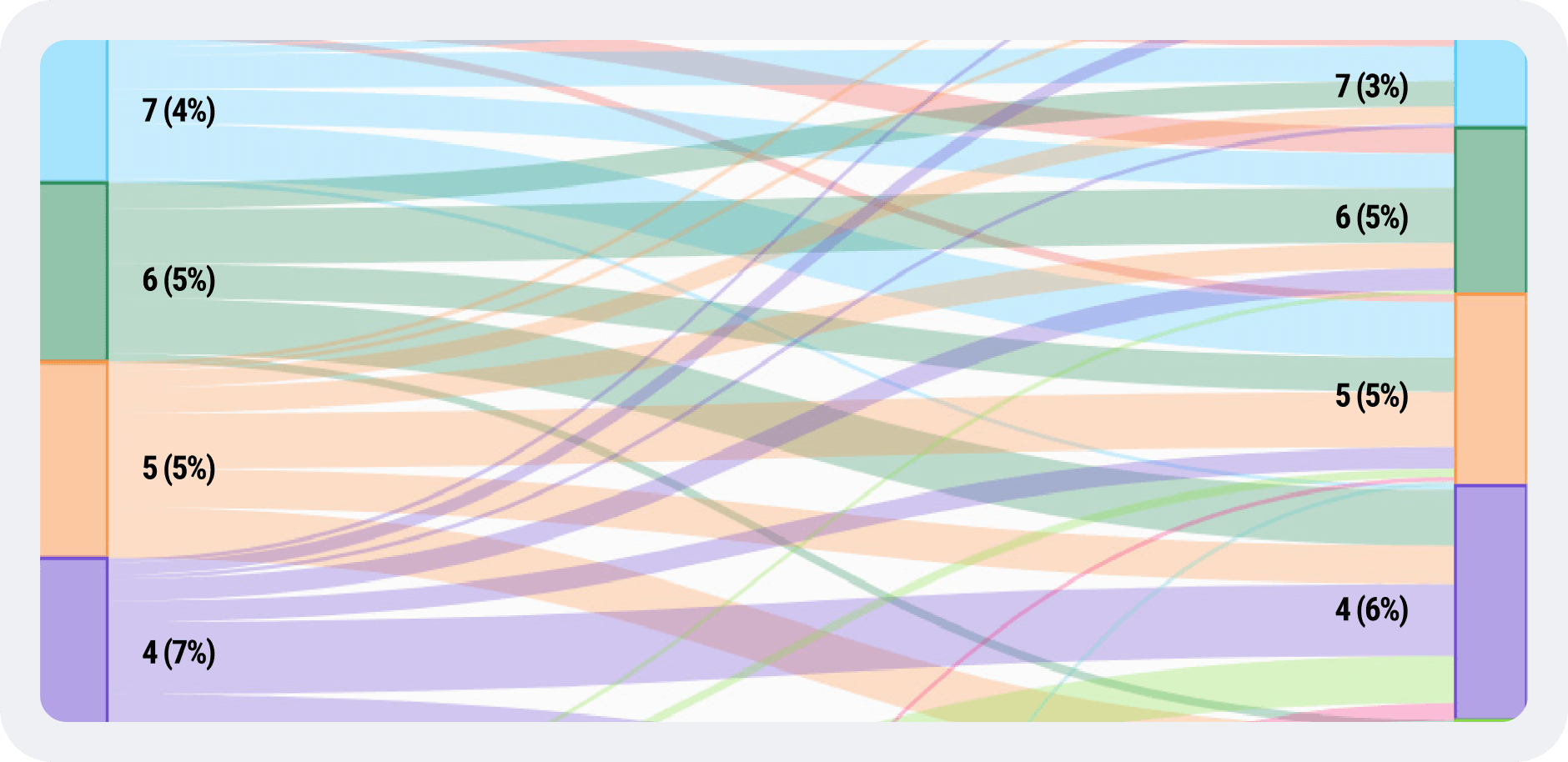

This visual showcases the difference in HCP volume deciles between longitudinal claims from Compass Patient (left side of chart) and Compass Prescriber (right side of chart) for a single specialty brand.

Get all insights on how to prioritize prescribers based on volume and opportunity

Establish a balanced territory design

Once you’ve created the right segments and targets, use the financial and workload assumptions (calls per day) to determine field size.

When designing a territory, it’s important to keep it as equitable as possible, balancing the number of targets and market volume in the geography. This ensures the right level of effort and opportunity for sales reps.

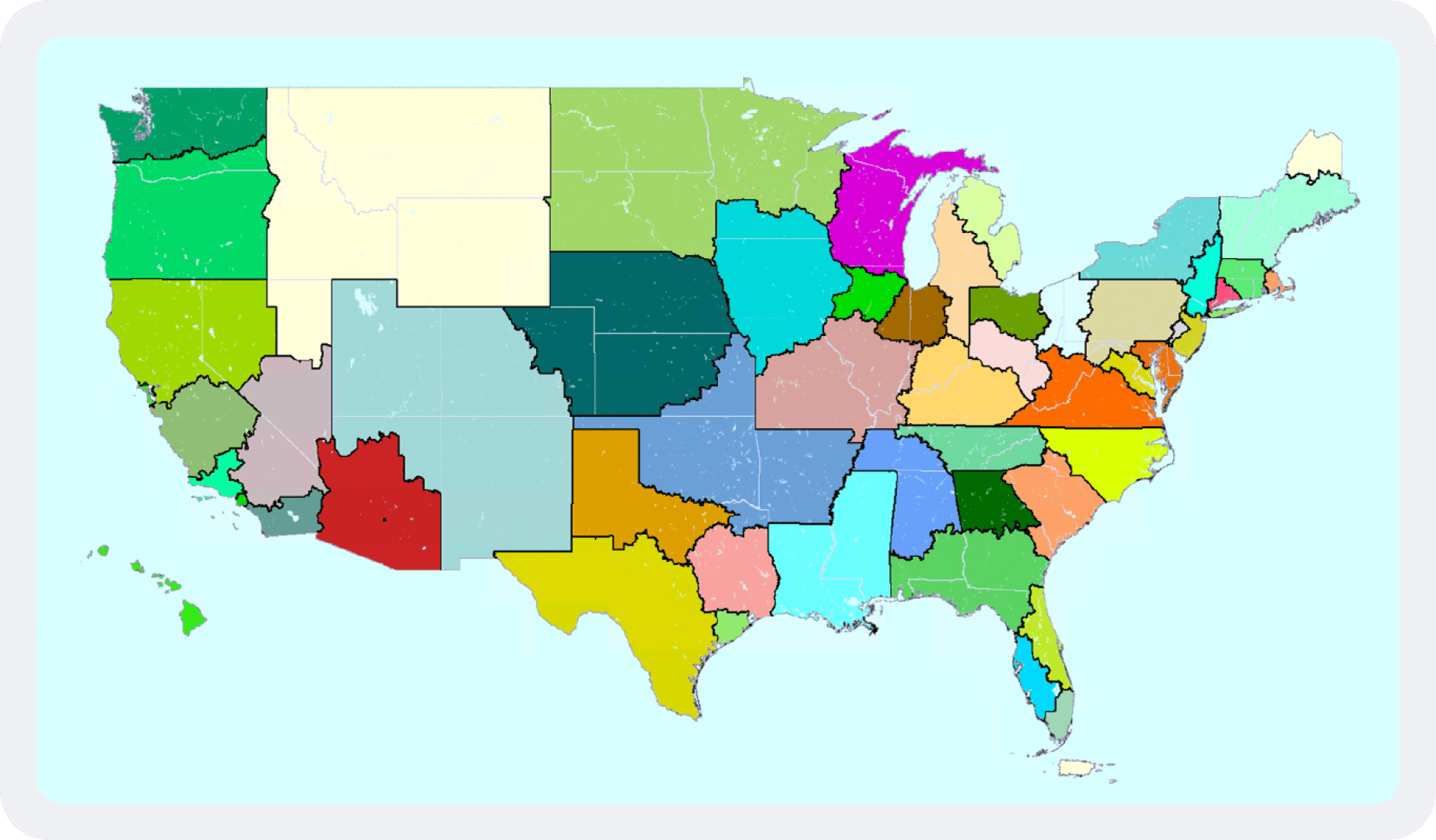

Sample creation of territories based on the location and distribution of targets for a particular brand.

Get all insights on how to establish a balanced territory design