RPA Bots, ICH E6(R3) Updates, M&A Activity:

7 Trends to Guide Your TMF Strategy

TMF leaders from top biopharma companies came together at the Veeva TMF Innovation Forum to discuss the evolution of TMF to become a strategic function.

A major part of this shift will be thanks to advances in automation, like bots to automate high-volume manual activities and study scores to synthesize TMF health. These approaches will free up TMF teams to focus on high-impact initiatives, including quality control of critical documents and inspection preparation. TMF leaders can also step up to provide guidance for broader teams during organization-wide changes like M&A.

-

Automation is reducing high-volume tasks

Robotic process automation (RPA) and other bots that automate high-volume manual activities are gaining popularity. They won’t eliminate tasks that require human intervention or are subject to inspection findings. However, they will drive critical efficiencies for TMF functions.

One top 20 biopharma has a fleet of more than 10 bots that complete tasks like document classification, quality review, and reconciliation.

“We call them digital workers,” says the company’s head of TMF. “They have their own user IDs and system access privileges. Each bot has a TMF ‘manager’ for training and performance measurement.”

The company views both its human and digital workers as integral parts of its TMF strategy. The head of TMF adds: “The digital workers take care of standardized, transactional tasks while human workers focus on decision-making, defining strategy, and managing stakeholders.”

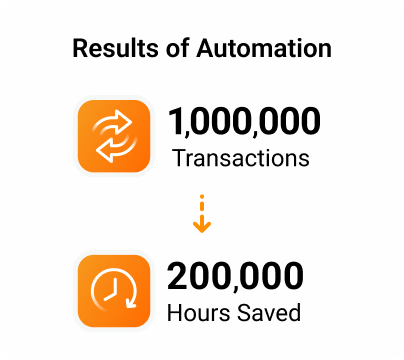

In four years, the company’s fleet of bots has completed more than 1,000,000 transactions and saved their TMF team 200,000 hours.

-

Comprehensive study scores deliver snapshot views of TMF health

Risk-based approaches are becoming the norm for TMF management. These practices help companies improve their TMF quality by focusing effort and expenses on the highest-risk documents. For example, a company following risk-based practices can allot more time to the quality control of documents critical to inspection readiness — like a site’s training record and qualifications — than to low-risk email communications with that site.

One large biopharma implemented risk-based reviews and created a weighted formula to assess its TMF health holistically. The formula combines quality, timeliness, and completeness metrics into a single study health score.

This initiative allows the company to compare study health across compounds and CROs. It also helps the company’s compliance managers more effectively engage study managers to drive TMF health.

“We’ve seen a broader embrace of the importance of TMF,” says one top 20 biopharma’s TMF business operations lead. “Our compliance manager is not a traffic cop who points out everything wrong with the TMF. Instead, they identify solutions.”

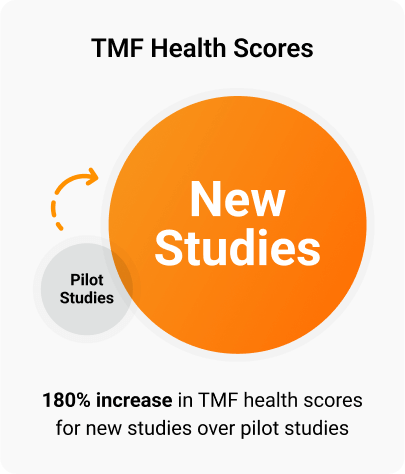

Since piloting this program, the company has increased the starting TMF health score average for new studies over pilot studies by 180%. This improvement for new studies demonstrates the effectiveness of combining a risk-based approach with study health scoring.

-

ICH E6(R3) is driving increased focus on risk-based TMF

ICH E6(R3) is still in the works but is expected to be finalized this year. The new regulation will change how TMF teams approach data integrity, systems, and retention rules in the following ways:

- The regulation highlights how companies can take a more thoughtful, risk-based approach to TMF management. As the Senior Director of TMF at one large biopharma states, “The industry is shifting toward adopting a risk-based approach with ICH (E6)R3. Every organization wants to do more with less, and this model enables us to do that while driving compliance, quality, and ensuring we have successful inspection outcomes.”

- It also outlines new expectations for essential or “potentially essential” records. The types of records now considered potentially essential are influenced by a broader range of factors related to specific trials. This means sponsors and CROs must work together to decide what constitutes “essential.”

- For the first time, ICH E6(R3) explicitly introduces the role of computerized systems in clinical trials. Investigator sites will now have to ensure that their systems are “fit for purpose.”

- ICH E6(R3) now refers to local laws for document retention rules, which likely means that inspection sites will offload most of this responsibility onto sponsors. Consequently, sponsors will need to adapt to local regulations, potentially necessitating new processes to manage retention.

ICH E6(R3) will also recognize records, rather than documents, to better reflect technology use in clinical trials.

-

Remote, hybrid, and multi-agency TMF inspections are the norm

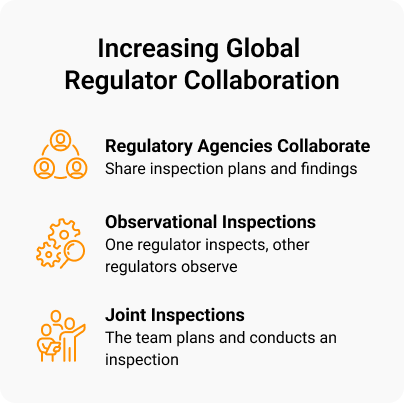

Remote and hybrid inspections are becoming the norm, and the FDA is now teaming up with other agencies such as the EMA, MHRA, and Health Canada. In some cases, the agencies are attending one another’s inspections, learning their approaches, and sharing their findings. This multi-agency approach adds layers of complexity for sponsors.

Inspectors are also asking sponsors to map the document lifecycle through sites, CROs, and ultimately their own systems. Some biopharmas are reviewing and reducing their alternate filing locations to improve document identification.

“Inspectors are more focused on the TMF — including data integrity, traceability, and audit trails — than they might have been five years ago,” says one biopharma’s senior director of TMF.

This heightened scrutiny emphasizes the importance of updating inspection-readiness processes, including audit trails.

“Regulatory agencies are asking for remote, full user access to the eTMF system,” says the head of TMF at a small biopharma. “I don’t anticipate the removal of on-site inspections, but I do expect they will do a higher total number of inspections because they don’t always have to be on-site.”

-

Biopharmas are considering tradeoffs when determining their TMF outsourcing strategies

Organizations are looking for ways to increase their control and data ownership, including insourcing targeted areas such as medical monitoring, data management, and vendor oversight. This comes amid the industry’s pendulum swing toward insourcing.

However, sponsors should also do a cost-benefit analysis to select the right operating model because CROs lose efficiencies from automation, integration, and staff training when they work in sponsor systems. Outsourcing strategy will also drive their internal staffing numbers.

One top 20 biopharma is 95% insourced, with a staff of over 60 clinical documentation associates (CDA) that work with study team members and conduct quarterly meetings. “The CDAs need to think critically about what documents are needed and influence study team members to drive outcomes,” says the biopharma’s associate director of TMF.

Meanwhile, another large pharma outsources significant portions of its TMF management to CROs and consulting vendors. They aim to resource one TMF lead for every 10 trials, site dependent, to drive TMF health.

“The role of the TMF lead is like the canary in the coal mine,” says the pharma’s associate director of TMF. “They help identify trends, but they’re not responsible for the content. We’re pushing hard to have TMF leads identify trends and then empower business functions to address those issues.”

Emerging biopharmas and biotechs can also consider a strategic combination of insourcing and outsourcing — including adapting their operating model on a study-by-study basis — to drive compliance while conserving resources.

-

TMF data standardization is increasing

The TMF Reference Model is now affiliated with the Clinical Data Interchange Standards Consortium (CDISC). This signals the industry’s move toward standardization and uniformity in how sponsors set up their eTMF systems, including metadata expectations.

“We’re very excited about this change,” says one CDISC TMF Reference Model steering committee member. “One of the biggest efforts will be bringing the TMF Reference Model out of the spreadsheet and into the CDISC library.”

Standardization will improve TMF management for sponsors, particularly those that can automate processes between connected systems like eTMF and CTMS. This change will also help streamline processes for CROs as operations become more consistent across sponsor environments.

-

TMF will play a bigger role in M&A

TMF leaders also have numerous opportunities to provide value to their broader organizations, including during mergers and acquisitions. TMF due diligence is a critical piece of the puzzle in M&A because it can:

- Identify hidden costs and possible filing delays for CFOs and/or investors

- Identify resources needed for TMF cleanup for heads of clinical operations

- Rationalize the key data and documentation and migration strategy for IT leaders

“Not assessing TMF as part of mergers and acquisitions can lead to surprises later,” says one small biopharma’s VP of clinical development operations. “TMF leaders can impress on their company leadership why this matters and help set their companies up for success.”

Continue the Discussion at Veeva Summit

Register for Veeva Summit in Boston this Sept. 9-10 to engage with TMF

leaders about improving trial efficiency and inspection readiness.